How do Companies bring Shut-in Wells back on, without the Need to Rehire?

For energy markets, the year 2020 started with a promising forecast of industry growth. But as we are all too painfully aware, it hasn’t quite worked out that way.

April oil prices dropped below zero for the first time in history, at -37.63/BBL. While prices have recovered since then, demand remains sluggish. The global pandemic has changed the way we all operate. Budgets have been cut. Offices closed. Many saw furloughs or layoffs. For the staff that remains, remote work is now the norm. They are doing the work of those who have not been recalled. Such is the market uncertainty that COVID-19 breeds.

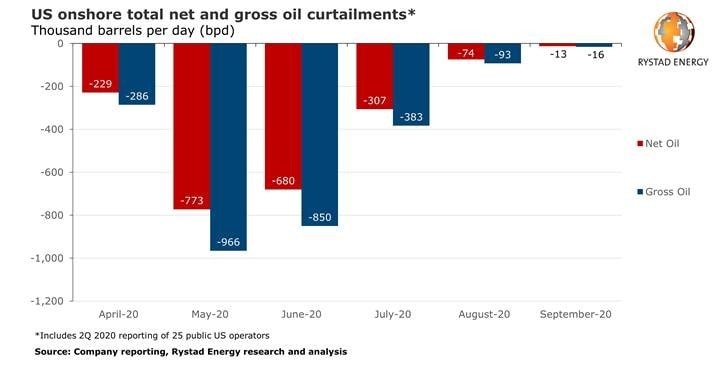

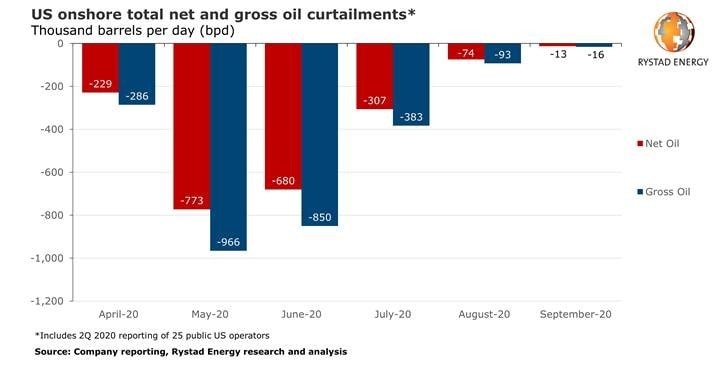

For many producers, sound cost and risk management called for the mass shut-in of mature wellsites this past spring. Fears of the unknown made these decisions perfectly logical at the time. As oil prices have recovered and started to stabilize in recent months, these same producers now want to restart shut-in wells and generate the revenue they represent.

How do companies bring shut-in wells back on, without the need to rehire?

The simple fact is that many producers were forced to lay off many of their contract pumpers and field operators to control costs. Even with the restart of more wells, the cost to rehire and the availability of top candidates has been impacted. Experienced talent may no longer be available. New talent will require training. Existing pumpers and operators will be required to do more with depleted resources.

Solving the Business Problem of Resuming Production on Shut-in Assets

For example, let’s say a producer has 130 producing wells that are maintained with three operator/pumpers. Let’s assume that they have another 130 wells temporarily shut-in that they now want to bring back on. Logic seems to say they would need to rehire another three operator/pumpers to manage those wells. At an estimated $85,000 – 130,000 per hire, including trucks and expenses, does the future production capacity of those shut-in wells justify these ongoing costs? At what oil price would this cost and spend be justified?

What if a solution existed that allowed this producer to restart these wells without having to bring their labor costs up to the level before the shut-ins?

Producing companies are adjusting to the “new normal” of lower commodity pricing and a reduction in growth by drilling. The focus is shifting to operating the assets they have most efficiently, at a lower cost. In the post-COVID market, it will still be preferable to operate more wells with less staff.

We know this because we are helping producers prove it again and again with the “Virtual Wellsite Visit”.

An Affordable Option to Restart Shut-in Wells at Current Staffing Levels

WatchDog® is a remote wellsite monitoring solution that powers the Virtual Wellsite Visit.

Our mission is to end the routine daily wellsite visit. This means that as producers expand their well count through acquisitions and drilling, they can manage that production with current staffing levels WatchDog delivers the capability and cost model to visit every well virtually, every day, from the convenience of one’s new home office or mobile device.

Field operators are then able to manage by exception, focusing only on problem wells that require immediate attention. Simply stated, they can do more in less time. They are alerted to potential environmental events like leaks where and when they occur. Continued production is assured while dramatically reducing operating costs per barrel.

WatchDog is the low-cost alternative to bring more shut-in wells back online without having to hire additional staff. It allows increased production while increasing the ratio of wells per operator/pumper. No need for field personnel to hop in their trucks and drive out to each and every site. Producers know the status of all their wells 24 hours a day, from anywhere.

One example is Teine Energy, which produces approximately 33,000 boe/day in both Alberta and Saskatchewan, Canada. “With the dramatic change in market conditions, we are moving aggressively towards solutions that increase our bottom line,” explains an Operations Manager at Tiene. “WatchDog provides our operators with a very efficient way to visit our wells virtually and concentrate their time on the activities and assets which require attention.”

The benefits of WatchDog for shut-in wells being restarted include:

- Reduced ongoing operating costs (e.g. labor, trucks)

- Increased operational efficiencies (e.g. staff time savings)

- Maximized production (e.g. increased runtime)

- Reduced impact from environmental incidents (e.g. leaks at wellhead, pipeline, tanks)

- Ancillary benefits such as lower GHG emissions, fewer auto accidents, and more

Unlike alternative solutions on the market, WatchDog can retrieve all information required of the daily visit at a fraction of the cost of traditional SCADA systems.

Justify the cost of bringing shut-in wells back into production. Watchdog is the proven technology solution to restart shut-in wells without the need to restore pre-pandemic operational costs. The decision is an easy one.